Venture Capital: An attractive asset class set to outperform

As we look ahead at what 2023 holds, all the key challenges faced by the global economy continue to persist – inflation continues to remain high albeit has peaked in mid-2022, central banks continue to squeeze liquidity out of the system through hawkish stances, level of price dislocation for public equities, particularly in the technology space, is high but more tolerable today than the peaks of 2021. With this macro backdrop, we have looked at what the next 5 years means for venture capital as an asset class and potential limited partners

With the twin agenda of maintaining a healthy unemployment rate while taming inflation to its 2% threshold, recent data suggests the US Federal Reserve might even have a chance of engineering a soft landing this year. Estimates suggest a sharp slowdown in core inflation estimates to 3% by the end of 2023 with only a 50bps uptick in employment rate. And there is increasing consensus that this high inflation regime is different from previous cycles that resulted in prolonged unemployment and recessionary environments

From a technology standpoint, the 2022 downturn – to put it mildly – has been an eye opener for investors globally. NASDAQ100, the benchmark for global technology investing, has witnessed a horrid 2022 with a 34% decline. Across the board, companies have reduced workforces by the thousands to rationalize costs and keep growth in check for the “high interest rate” regime. The jury however is still out whether the decline and sell-offs in public markets have also been factored into private market valuations. Although late-stage valuations and companies have been repriced, early-stage companies and valuations are still elevated and could see a decline in the next two to three quarters, according to J.P. Morgan.

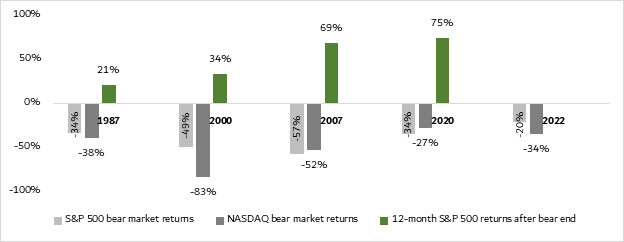

This ongoing reb and normalization of asset prices presents a once-in-a-lifetime for private investors with dry powder to be allocated or new funds to deploy. An analysis of four previous downcycles stretching back to the 1987 cycle indicates that public market indices have bounced back by ~50% from the bottom within a 12-month window.

Public market returns – last 5 economic downturns

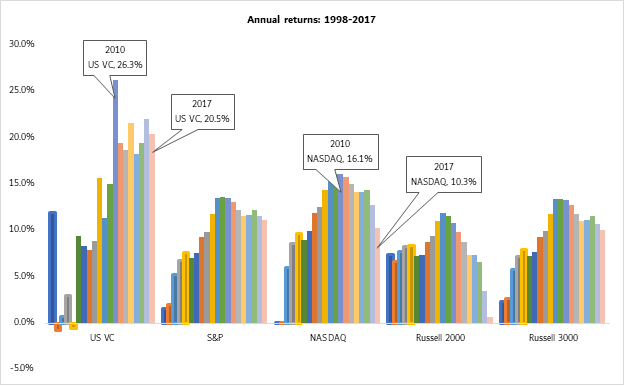

What gives further confidence as a venture capital firm is the significant outperformance private investing has delivered over the last 15 years. In an ideal scenario where the Fed funds rate falls back to its long-term range of 0-2% and with inflation in check, vintages of venture funds raised immediately after a bottom year have delivered on average a 10% higher return compared to public market indices.

Public markets v. US venture capital vintages – last 20 years

The wisdom of one of the greatest investment minds aside, the data tells us the same thing. What we all know qualitatively from conversations with the global VC community - the flight to quality, correction in valuations and renewed emphasis on fundamentals of a business - all of which are expected to drive higher quality investments and consequently returns is also backed by historical data. There exists a strong correlation between bear markets and VC fund returns with funds of vintages coinciding with bear markets significantly outperforming public market returns - a phenomenon that repeats itself across market cycles! A recent The Wall Street Journal article further corroborates this trend, with "over $150 billion raised in the first three quarters of 2022 by VC funds and first-time funds on pace to match or exceed nearly every year before 2021."

Limited Partners and Investors choosing to sit on the sidelines and with high cash exposure are at risk of potentially missing out on this excellent opportunity to make top future returns. Amidst the doom and gloom of 2022, we firmly believe now is the best time to invest in VC funds and are open for business with our India-focused Alicorn India Fund. If you are keen to learn more and are building businesses for India and the World, reach out to the team!

View All Perspectives

View All Perspectives