Why we are bullish on the India early-stage technology opportunity?

Despite the ongoing correction, investments into Technology and Innovation over the last two decades has propelled the global economy into a new age of connectedness. Markets such as the United States and China have grown into economic superpowers with robust digital infrastructure on the back of technological innovation.

In a similar manner, India has seen a surge in technology activity in its own right. Supported by strong underlying fundamentals, the Indian economy has grown into a $3tr economy, a 9x growth since liberalization of the economy in 1991, with ~15% economic output (~$330b in 2021) from the India technology sector. The Indian consumer today regularly accesses consumer services such as availing credit, conducting transactions, purchasing homes / cars / other assets, availing education, accessing healthcare and multiple other services digitally via the Internet, thanks to a rapid uptake in mobile connections and a continuous fall in data and Internet prices.

The Government of India has also taken a digital first approach for economic development and empowerment, launching initiatives such as Aadhaar with 1.2b unique digital identities and has streamlined user verification and KYCs etc, Unified Payments Interface (UPI) that processed 74 billion transactions and $1.57tr in transaction value in 2022. To put in context, UPI transaction value in CY22 stands at ~46% of the projected India FY23 GDP!

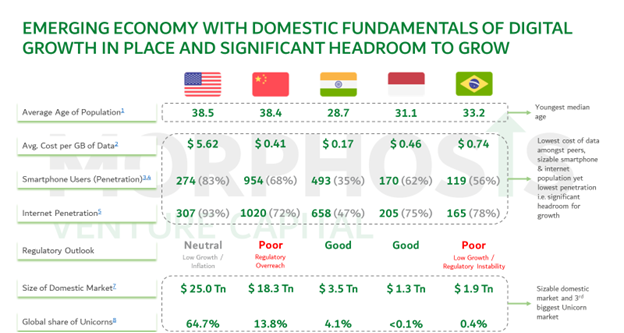

The digital-first approach by the Government, combined with the demographic advantage of India and other SEA markets has resulted in a very attractive macroeconomic environment for Indian tech. Compared to other key geographies, India ranks ahead on technology enablers such as very low data cost, large mobile and smartphone user base, sizeable domestic consumption economy, and has tremendous upside from continued digital adoption and increasing technology spend and development.

India vs other geographies

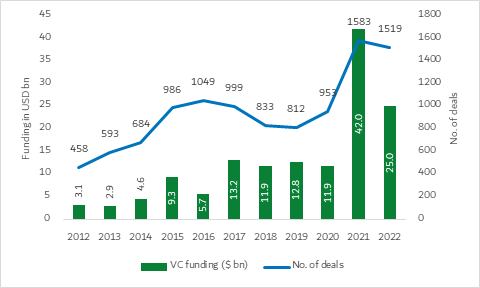

We strongly believe this is just the beginning of the coming-of-age of the India technology sector. In addition to the macro tailwinds, our bullish view for India stems from the evolution of the startup and founder ecosystem in the country. Startup founding and correspondingly, venture funding has grown manifold over the last decade, barring 2022 when overall investing took a hit owing to macroeconomic conditions. According to a recent Inc42 report, the Indian startup ecosystem has witnessed launch of ~58k companies between 2012-22. Average round size also saw a steady uptick, growing from $6m in 2012 to $17m by 2022 – a sign of maturing companies raising later rounds as well as expanding round sizes.

India v other geographies: comparison on macro metrics

Moreover, the last decade has seen the rise of 108 unicorns and the specialization of Indian startups tackling opportunities and providing solutions on a global scale. This “Built in India for the World” theme started out with the growth of the ITES sector and has since expanded into innovative product-led companies with companies like Freshdesk, Zoho, Postman and Hasura becoming poster boys in their respective domains on a global level. What this success on a global scale has facilitated is the increase in seasoned professionals who have moved back to India to startup on their own. As a venture capital firm, the migration back to India from experienced technology professionals is a very encouraging development that contributes to the continued development of the ecosystem manifold.

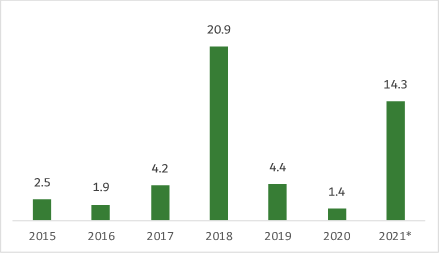

In addition to the macroeconomic, demographic, and technological infrastructure tailwinds that have supported the growth of a vibrant entrepreneurial ecosystem, India has also developed and created successful exits to domestic and international investors. While 2021 continued to be an outlier by delivering exits of $14+b driven by a few large secondary transactions, the fundamentals look good for long-term validation of secondary transactions as more strategic market participants in the form of corporate venture arms and other institutions become more active in the market. According to CBInsights, CVC-backed funding to India-based startups were above $1b for the past 5 quarters before falling to $0.3b in Q3 2022. Over the long-term, strong and sustainable businesses being built in India will continue to attract strategic investors to participate and even lead investments in the mid-to-late stages.

India v other geographies: comparison on macro metrics

We are excited about participating and playing our role in shaping the future of the Indian startup and technology ecosystem as early-stage backers of resolute founders. If you are a founder building in the B2B and Enterprise Technology space, check out our investment thesis and reach out to the team to have a chat!

View All Perspectives

View All Perspectives